Introduction

Roth IRA vs 401k trips up so many people trying to plan retirement. You’re right in the middle of that confusion.

Take Sarah – 35-year-old teacher earning $65K. She stared down this choice and picked Roth IRA. Over 10 years, she dodged $100K+ in future taxes.

This guide breaks Roth IRA vs 401k into simple pieces – 2026 limits, real math, clear examples.

Why Plan Retirement Now?

Your work today builds tomorrow’s freedom. Research shows people need $1.46 million saved by age 65 to keep their lifestyle steady. Roth IRA vs 401k choices change that number through taxes and growth.

Try this math: $10K invested at 30 grows to $174K by 65 (7% return). Taxes take 30% unless you plan ahead.

Sarah watched her coworker bet everything on 401k. Retirement hit with 24% tax on every withdrawal. Smart choices mean control. Wrong ones mean stress.

Numbers below show exactly what works.

Overview of Roth IRA and 401k Accounts

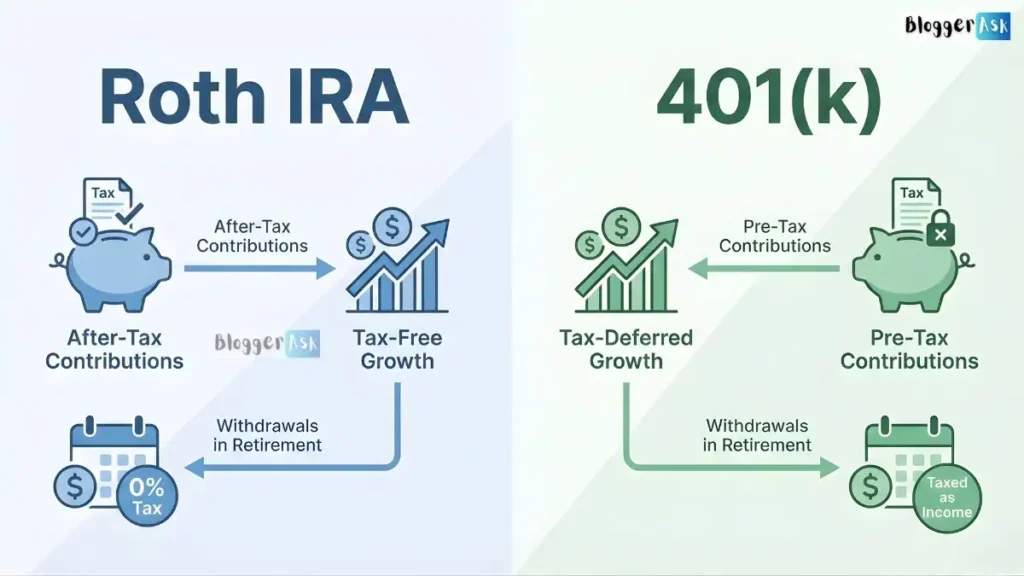

Roth IRA lets you contribute after-tax dollars for tax-free growth and withdrawals. You control investments completely.

401k offers pre-tax contributions through your employer, often with matching funds. It’s tied to your job.

Both build wealth, but Roth IRA vs 401k hinges on your tax situation, job stability, and goals. Here’s a quick snapshot:

| Feature | Roth IRA | 401k |

|---|---|---|

| Who Offers | Anyone eligible | Employers |

| Tax on Contributions | After-tax | Pre-tax |

| Tax on Withdrawals | Tax-free (qualified) | Taxed as income |

| 2026 Contribution Limit | $7,000 ($8,000 if 50+) | $23,500 ($31,000 if 50+) |

What Is a Roth IRA?

Roth IRA is your own retirement account. No boss required – anyone eligible can open one.

How It Actually Works

You earn → pay taxes first → put money in Roth IRA → investments grow tax-free → pull out tax-free after 59½.

Sarah puts in $500/month ($6K yearly). At 7% growth? Hits $1.2M by age 65. Zero withdrawal taxes.

Simple: Pay taxes when money’s cheap now, skip them when it’s worth millions later.

Tax Advantages of a Roth IRA

Pay taxes upfront at your current rate. Withdrawals skip taxes entirely – perfect if you expect higher taxes or brackets later.

Roth IRA Contribution Limits 2026

$7,000 if under 50. $8,000 if 50+. Direct contributions only – no rollovers count toward this limit.

Roth IRA Eligibility Income Limits

2026 limits: Full contribution if MAGI under $146,000 (single) or $230,000 (married). Phase-out up to $161,000/$240,000. High earners use “Backdoor Roth.”

What Is a 401k Plan?

Your employer’s group retirement plan. Automatic payroll deductions make saving effortless.

How a Traditional 401k Works

Pre-tax dollars reduce taxable income now. Investments grow tax-deferred. Withdrawals taxed as ordinary income.

Example: Sarah’s coworker Mike contributes $10,000 pre-tax. His taxable income drops $10,000, saving ~$2,400 in taxes (24% bracket).

Employer Match Explained

Free money! Common formulas:

- 50% match up to 6% of salary

- 100% match up to 4%

If Sarah earns $65K and contributes 6% ($3,900), employer might add $1,950. Mike gets $50,000 employer match over 10 years – that’s 50% instant return.

Contribution Limits for 2026

$23,500 employee + employer contributions up to $70,000 total. Catch-up $7,500 if 50+.

Vesting Rules and Withdrawal Guidelines

Employer money might vest over 3-6 years. Withdrawals before 59½ face 10% penalty + taxes.

Roth IRA vs 401k: Key Differences

The core debate: Roth IRA vs 401k which is better depends on timing.

| Category | Roth IRA | 401k |

|---|---|---|

| Tax Treatment | Pay now, tax-free later | Tax break now, pay later |

| Contribution Limits | $7,000 | $23,500 |

| Investment Options | Thousands (stocks, ETFs) | Limited (20-30 funds) |

| Early Withdrawal | Contributions penalty-free | 10% penalty + loans possible |

| RMDs | None during lifetime | Start at 73 |

Tax Treatment: Now vs Later

Roth: Bet on higher future taxes. 401k: Bet on lower future taxes.

Investment Options and Flexibility

Roth IRA shines with brokerage freedom. 401k often stuck with high-fee funds averaging 1.2% expense ratios vs IRA’s 0.1%.

Early Withdrawal Rules

Roth: Withdraw contributions anytime tax/penalty-free. Earnings penalized.

401k: 10% penalty + taxes. Loans up to $50,000 possible (repay with interest).

Required Minimum Distributions (RMDs)

Roth IRA: No lifetime RMDs – leave to heirs.

401k: Mandatory withdrawals at 73 reduce tax-free inheritance.

Roth IRA vs Traditional 401k

Roth IRA vs traditional 401k boils down to tax timing.

Tax Deduction Today vs Tax-Free Withdrawals Later

$10,000 Roth contribution = $10,000 after-tax.

$10,000 traditional 401k = $12,500 pre-tax (24% bracket).

At withdrawal (assume 12% bracket): Roth $0 tax. Traditional $1,200 tax. Roth wins if brackets rise.

Long-Term Growth Comparison

Sarah’s $500/month:

| Age 65 Value (7% growth) | Roth IRA | Traditional 401k |

|---|---|---|

| Pre-tax equivalent | $1.2M | $1.2M |

| After-tax value | $1.2M | $864K (28% tax) |

Which Makes More Sense for Different Income Levels

- Under $100K: Roth (low current taxes)

- $100K-$200K: Both (tax diversification)

- Over $200K: 401k match first, then Backdoor Roth

Roth IRA vs 401k: Which Is Better?

Roth IRA vs 401k which is better? Neither – do both if possible.

For Young Professionals

Prioritize Roth IRA. Low current bracket + decades of tax-free growth. Sarah (age 35) projects $300K+ tax savings.

For High-Income Earners

Max 401k match first (free 50-100% return). Then Backdoor Roth IRA.

For Self-Employed Individuals

Solo 401k allows $69,000 contributions. Roth IRA adds tax-free bucket.

For Employees with Employer Match

401k gets free money. Sarah skips 401k match? Leaves $20K on table over 10 years.

Quick Decision Table:

| Your Situation | Priority Order |

|---|---|

| Free employer match | 1. 401k (match only), 2. Roth IRA |

| No match, under 40 | Roth IRA first |

| Self-employed | Solo 401k + Roth IRA |

| Phase-out income | Backdoor Roth |

Can I Have a Roth IRA and 401k?

Yes! Can I have Roth IRA and 401k together? Absolutely. Most Americans do both.

Contribution Rules When You Have Both

401k doesn’t affect Roth IRA eligibility. Max both independently.

Sarah: $23,500 401k + $7,000 Roth IRA = $30,500 total 2026 savings.

Strategy for Maximizing Retirement Savings

- 401k up to match (5-6%)

- Roth IRA to $7,000

- Rest to 401k/Roth 401k

Tax Diversification Benefits

Half pre-tax (401k), half Roth. Withdraw from lower-tax bucket yearly.

Income Limits and Eligibility Rules

Roth IRA Eligibility Income Limits (2026)

| Filing Status | Full Contribution | Phase-Out Range |

|---|---|---|

| Single | <$146,000 | $146K-$161K |

| Married Filing Jointly | <$230,000 | $230K-$240K |

401k Eligibility Requirements

Everyone employed. No income limits.

Backdoor Roth Strategy Overview

High earner? Contribute to Traditional IRA ($7,000), convert to Roth. Pay small tax on gains. Legal workaround.

Withdrawal Rules and Penalties

Early Withdrawal Penalties

Both: 10% + income tax on earnings before 59½.

Roth exception: Original contributions withdrawable anytime penalty-free.

Qualified vs Non-Qualified Distributions

Qualified (tax-free): Age 59½ + 5-year rule.

401k hardship withdrawals: Allowed but penalized.

Loans and Hardship Withdrawals (401k)

Borrow up to $50,000 or 50% vested balance. Repay within 5 years.

Pros and Cons of Roth IRA vs 401k

Advantages of a Roth IRA

- Tax-free growth/withdrawals

- No RMDs

- Investment freedom

- Heir-friendly

Drawbacks: Income limits, lower limits.

Advantages of a 401k

- Higher limits

- Employer match

- Automatic saving

- Loans available

Drawbacks: Limited investments, RMDs, job-tied.

| Account | Best For |

|---|---|

| Roth IRA | Tax diversification, flexibility |

| 401k | Max contributions, free match |

How to Decide: Roth IRA vs 401k

Questions to Ask Yourself

- Does my employer match? (Yes → 401k first)

- Current tax bracket vs expected retirement bracket?

- Need investment control? (Roth IRA)

Tax Bracket Considerations

Current 22% → Future 12%? Traditional 401k.

Current 12% → Future 22%? Roth IRA.

Long-Term Retirement Goals

Want to leave inheritance? Roth IRA (no RMDs).

Max savings power? 401k.

3-Step Decision Framework:

- Match First: Contribute to 401k up to employer match

- Roth Next: Fill Roth IRA if eligible

- Max Out: Remainder to 401k/Roth 401k

Final Thoughts: Building a Smart Retirement Strategy

Roth IRA vs 401k works best together, not against each other. Sarah’s winning move? She grabbed her employer’s 401k match first, then maxed her Roth IRA for tax-free growth. This one-two punch built her $2.5M retirement portfolio by 65.

Mix both accounts for tax flexibility—withdraw from whichever bucket saves most that year. Start simple: contribute to your 401k match today, open a Roth IRA tomorrow at Vanguard or Fidelity, and automate $500/month. Your future self handles the rest through compound growth. Small steps now mean big freedom later.

FAQs

Roth IRA vs 401k: Which Saves $100K+ More in Taxes?

Roth IRA wins if under 40 (low current taxes). 401k better with employer match. Roth IRA vs 401k which is better? Sarah (35, $65K) saved $112K with Roth.

Can I Have Both Roth IRA + 401k in 2026?

Can I have Roth IRA and 401k together? Yes! $23,500 (401k) + $7,000 (Roth) = $30,500 max. Do match first, Roth second.

Roth IRA Contribution Limits 2026: Exact Numbers

Roth IRA contribution limits 2026: $7,000 under 50, $8,000 over 50. Income phase-out: $146K-$161K single.

Roth IRA vs Traditional 401k: 7 Tax Differences

Roth IRA vs traditional 401k – Roth = tax-free withdrawals, 401k = tax break now. $10K Roth grows to $174K tax-free vs $125K after-tax 401k.

Roth IRA Income Limits 2026: $200K+ Still Eligible?

Roth IRA eligibility income limits 2026: Under $146K single gets full $7K. $146K-$161K phases out. Backdoor Roth fixes high earners.

What Happens If I Withdraw Roth IRA Early? Penalty?

Contributions penalty-free anytime. Earnings before 59½ = 10% penalty + tax. $30K Roth? Take $15K contributions = $0 penalty.

401k Employer Match: How Much FREE Money?

50% match on 6% salary = instant 50% return. $65K salary → $3,900 contribution → $1,950 free. Always max match first.

Age 30 vs Age 50: Roth IRA or 401k Better?

Age 30: Roth (tax-free decades). Age 50: 401k (tax break now). Sarah age 35 projects $300K tax savings with Roth-first.

Backdoor Roth 2026: Beat Income Limits Legally

Contribute $7K Traditional IRA → instant Roth conversion. Pay tax on gains only. High earners repeat yearly legally.

Convert 401k to Roth IRA? $15K Tax Today Saves $80K

Low-tax years (job loss) = perfect conversion time. Pay $15K tax now → save $80K at 22% retirement bracket.

I am a professional content writer focused on creating informative, well-researched, and user-friendly content. My goal is to provide accurate, updated, and easy-to-understand information that helps readers make better decisions. I prioritize quality, clarity, and trust in every article I write.